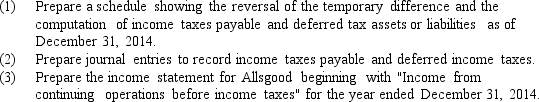

Allsgood Appliances computed a pretax financial loss of $60,000 for the first year of its operations ended December 31,2014.Analysis of the tax and book basis of its liabilities disclosed $80,000 in accrued warranty expenses on the books that had not been deductible from taxable income in 2014,but would be deductible in future years when the warranty expenses were paid.

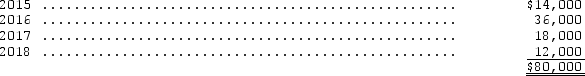

The future warranty payments are expected to occur in the following pattern:

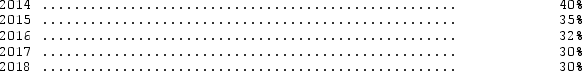

The enacted tax rates for this year and the next four years are as follows:

The enacted tax rates for this year and the next four years are as follows:

Use the provisions of FASB Statement No.109.

Use the provisions of FASB Statement No.109.

Definitions:

EOQ

Economic Order Quantity, a formula used to determine the optimal quantity of stock to order that minimizes total inventory costs.

One-Shot Approach

The one-shot approach is a method that attempts to resolve or achieve a particular goal in a single, concentrated effort.

Net Present Value

The variance between cash inflows' present value and cash outflows' present value across a specific timeframe.

Monthly Interest Rate

The proportion of a loan or investment's principal that is charged or earned as interest every month, recalculated based on the period.

Q1: Diamond,Inc.purchased a machine under a deferred payment

Q17: Basic earnings per share represents the amount

Q21: Which factor would most likely cause a

Q32: For a company having several different issues

Q45: When bonds are sold between interest dates,any

Q47: The composite depreciation method<br>A) is applied to

Q56: During 2014,Ongoing Company became involved in a

Q70: Gunther Inc.purchased $400,000 of Malone Corp.ten-year bonds

Q74: Pepitone Inc.exchanged a machine costing $400,000 with

Q79: In exchange for the rights inherent in