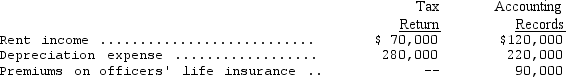

Bodner Corporation's income statement for the year ended December 31,2014,shows pretax income of $1,000,000.The following items are treated differently on the tax return and in the accounting records:  Assume that Bodner's tax rate for 2014 is 30 percent.What is the amount of income tax payable for 2014?

Assume that Bodner's tax rate for 2014 is 30 percent.What is the amount of income tax payable for 2014?

Definitions:

Onscreen Journal

A digital record or interface where financial transactions are entered and stored electronically.

Template Name

The designated title given to a predefined format or structure used for documents, spreadsheets, or databases, aiding in standardizing the creation of new instances.

Reminder

A tool or alert designed to notify someone of an upcoming event, due date, or task.

Scheduled Transactions

Transactions that have been arranged to occur at a specific, predetermined time, such as automated bill payments or regular financial transfers.

Q1: How much interest expense should Gunnison record

Q11: Which of the following principles best describes

Q19: Which of the following is most likely

Q26: Which of the following transactions would not

Q40: On January 1,2014,Benjamin Industries leased equipment on

Q45: For which type of derivative are changes

Q54: Under current GAAP,a company with a complex

Q63: For 2014,Celestion should report interest revenue of<br>A)

Q65: Which of the following arguments is supportive

Q70: Mint Company sponsors a noncontributory,defined-benefit pension plan.At