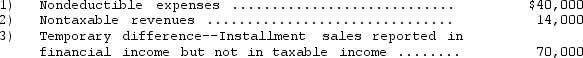

Smart Services computed pretax financial income of $220,000 for its first year of operations ended December 31,2014.In preparing the income tax return for the year,the tax accountant determined the following differences between 2014 financial income and taxable income:

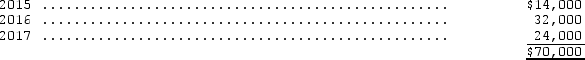

The temporary difference is expected to reverse in the following pattern:

The temporary difference is expected to reverse in the following pattern:

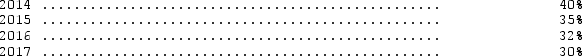

The enacted tax rates for this year and the next three years are as follows:

The enacted tax rates for this year and the next three years are as follows:

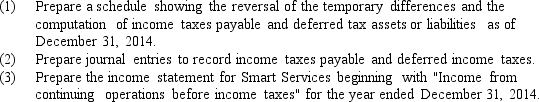

Use the provisions of FASB Statement No.109.

Use the provisions of FASB Statement No.109.

Definitions:

Electronic Commercial Messages

Any type of message, such as emails or texts, that is primarily intended for marketing or advertising purposes.

PIPEDA

The Personal Information Protection and Electronic Documents Act, a Canadian law governing data privacy.

Right to Privacy

The right of individuals to keep their personal information confidential and protected from unauthorized disclosure.

Downsizing Strategies

Approaches undertaken by businesses to reduce its size, cost structure, or workforce to improve efficiency and profitability.

Q3: To compute the price to pay for

Q11: If the bonds were issued at 97

Q30: Which of the following is NOT a

Q32: The issuance of shares of preferred stock

Q36: The SEC currently requires foreign companies that

Q40: On July 1,2014,Hilltop Systems acquired 8,000 shares

Q49: On January 1,2013,Venice Company initiated a stock

Q51: Pandora Company determined that it has an

Q73: On February 1,2015,Gaslight Corp.issued 12 percent,$2,000,000 face

Q81: A company issued rights to its existing