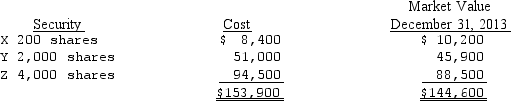

During 2013,Rubble Company purchased marketable equity securities as a short-term investment and classified them as trading securities.The cost and market value at December 31,2013,were as follows:  Rubble sold 1,000 shares of Company Y stock on March 16,2014,for $24 per share,incurring $1,300 in brokerage commissions and taxes.On the sale,Rubble should report a realized loss of

Rubble sold 1,000 shares of Company Y stock on March 16,2014,for $24 per share,incurring $1,300 in brokerage commissions and taxes.On the sale,Rubble should report a realized loss of

Definitions:

Fixed Manufacturing Overhead

Regular, consistent costs associated with operating a manufacturing facility that do not vary with the level of production, such as salaries and rent.

Contribution Margin

The amount by which a product's selling price exceeds its total variable costs, contributing to covering fixed costs and generating profit.

Production Constraint

A limitation or bottleneck in a manufacturing process that affects the overall output.

Contribution Margin Ratios

The proportion of sales revenue that remains after variable costs are subtracted, indicating how well a company can cover fixed costs and generate profits.

Q20: Diamond Company changed from the completed-contract method

Q38: Ending inventory for 2012 is overstated by

Q40: Which of the following assets generally is

Q51: Which of the following is true of

Q54: Using the information above and assuming the

Q54: If the replacement cost of a unit

Q62: On January 1,2014,Kimba Co.paid $500,000 for 20,000

Q64: Avionics Inc. ,a dealer in machinery and

Q67: In computing the change in deferred tax

Q76: Which of the following is correct regarding