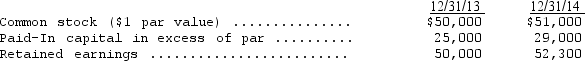

The following data are extracted from the stockholders' equity section of the balance sheet of Guthrie Corporation:  During 2014,the corporation declared and paid cash dividends of $7,500 and also declared and issued a stock dividend.There were no other changes in stock issued and outstanding during 2014.Net income for 2014 was

During 2014,the corporation declared and paid cash dividends of $7,500 and also declared and issued a stock dividend.There were no other changes in stock issued and outstanding during 2014.Net income for 2014 was

Definitions:

Bad Debts Expense

The cost associated with accounts receivable that a company does not expect to collect due to customer default.

Receivables

Receivables, often called accounts receivable, are the funds owed to a company by clients or customers for goods or services already delivered or used but not yet paid for.

Bad Debts

Financial losses attributed to customers who fail to pay what they owe for purchased goods or services, often considered as an expense in accounting.

Adjustment

An accounting action that alters the value of accounts in the ledger to reflect their true balances at the period end, often related to expenses and revenues.

Q13: Alpha had taxable income of $1,500 during

Q17: Basic earnings per share represents the amount

Q20: Treasury stock was acquired for cash at

Q30: The gross profit method of inventory valuation

Q62: In January 2014,Shone Company exchanged an old

Q68: The Kidde Corporation uses the lower-of-cost-or-market method

Q74: Pepitone Inc.exchanged a machine costing $400,000 with

Q75: Tundra Co.incurred research and development costs in

Q79: Which of the following is NOT a

Q107: See information for Alana's Clothing Store above.Using