Irvington Manufacturing Inc.purchased a new machine on January 2,2014,that was built to perform one function on its assembly line.Data pertaining to this machine are:

Acquisition cost $330,000

Residual value $30,000

Estimated service life:

Years 5

Service hours 250,000

Production output 300,000

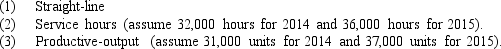

Using each of the following methods,compute the annual depreciation rate and charge for the years ended December 31,2014,and 2015:

Definitions:

Income Statement

A financial statement that shows a company's revenues and expenses, and ultimately its profit or loss, over a specific period of time.

Earnings Performance

An evaluation of a company's profitability over a specific period, often analyzed through metrics like EPS (earnings per share).

Q10: Steinman Construction Company uses the percentage-of-completion method

Q13: Lex Soaps purchased a machine on January

Q14: The following information is available for the

Q17: A gain on the sale of a

Q22: Which of the following best describes the

Q26: On January 1,2013,Pastel Colors Corporation purchased drilling

Q30: The plan of organization and all the

Q35: Danville Corporation bought a new machine and

Q42: International accounting standards currently are moving toward

Q45: Latone Company began operations in 2014.During the