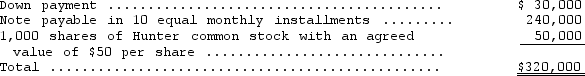

In January,Fanning Corporation entered into a contract to acquire a new machine for its factory.The machine,which had a cash price of $400,000,was paid for as follows:  Prior to the machine's use,installation costs of $10,000 were incurred.The machine has an estimated useful life of ten years and an estimated salvage value of $10,000.What should Hunter record as depreciation expense for the first year under the straight-line method?

Prior to the machine's use,installation costs of $10,000 were incurred.The machine has an estimated useful life of ten years and an estimated salvage value of $10,000.What should Hunter record as depreciation expense for the first year under the straight-line method?

Definitions:

Fossils

Remains or impressions of ancient organisms preserved in rock or other geological materials.

Impact Craters

Circular depressions on the surface of planets, moons, or other celestial bodies, formed by the high-speed impact of a meteoroid, asteroid, or comet.

Point Bar

A depositional feature made of sand and gravel that forms on the inside bend of streams and rivers.

Erosional Features

Landforms created by the removal of soil, rock, or sediment through water, wind, ice, or other natural forces.

Q3: The following information is provided by Horizons

Q3: On December 31,2013,Breezeway,Inc. ,reported a current deferred

Q5: Which of the following is correct?<br>A) The

Q5: When an exchange of similar assets involves

Q12: The Maker Company exchanged 25,000 shares of

Q15: Partial balance sheet data and additional information

Q67: Stock warrants outstanding should be classified as<br>A)

Q75: Tundra Co.incurred research and development costs in

Q78: In 2014,Climber Corporation issued for $110 per

Q114: Asteroid Sales Corp.was organized on January 1,2013.On