From Inception of Operations to December 31,2013,Centaur Corporation Provided for Uncollectible

From inception of operations to December 31,2013,Centaur Corporation provided for uncollectible accounts receivable under the allowance method: Provisions were made monthly at 2 percent of credit sales;bad debts written off were charged to the allowance account;recoveries of bad debts previously written off were credited to the allowance account;and no year-end adjustments to the allowance account were made.Centaur's usual credit terms are net 30 days.

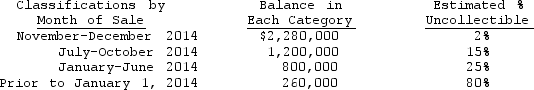

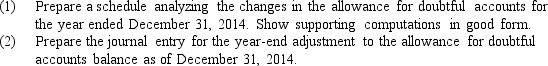

The credit balance in the allowance for doubtful accounts was $260,000 at January 1,2014.During 2014,credit sales totaled $18,000,000,interim provisions for doubtful accounts were made at 2 percent of credit sales,$180,000 of bad debts were written off,and recoveries of accounts previously written off amounted to $30,000.Centaur installed a computer system in November 2014 and an aging of accounts receivable was prepared for the first time as of December 31,2014.A summary of the aging is as follows:

Based on the review of collectibility of the account balances in the "prior to January 1,2014" aging category,additional receivables totaling $120,000 were written off as of December 31,2014.Effective with the year ended December 31,2014,Centaur adopted a new accounting method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging analysis of accounts receivable.

Based on the review of collectibility of the account balances in the "prior to January 1,2014" aging category,additional receivables totaling $120,000 were written off as of December 31,2014.Effective with the year ended December 31,2014,Centaur adopted a new accounting method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging analysis of accounts receivable.

Definitions:

Stakeholders

Individuals, groups, or organizations that have a vested interest in the performance, decisions, and success of a company or project, including employees, investors, customers, and suppliers.

Quality Service

the measure of how well the service level delivered matches customer expectations.

Sustainable Competitive Advantage

A long-term strategy that cannot be easily duplicated by competitors, allowing an organization to perform better over time.

Human Resources

The department within an organization that deals with the management, support, and development of its employees.

Q10: The amount of income reported for tax

Q19: The Fanfare Company applied for and received

Q26: In relation to a set of 2015

Q30: Treasury stock should be reported<br>A) as a

Q35: When a company purchases land with a

Q45: When bonds are sold between interest dates,any

Q46: During the year,Samuels Company reported net income

Q58: Generally,recognition criteria are met and revenues are

Q89: Budson Company needs an estimate of its

Q99: Carryon Co. ,a manufacturer,had inventories at the