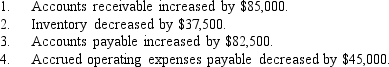

Net income for the Hot Springs Company for the most recent year was $150,000,consisting of $865,000 of revenues,$360,000 of cost of goods sold,and $365,000 of operating expenses.The following changes in current assets and current liabilities have been identified:

Required:

Required:

Calculate the cash flows from operating activities for the year,applying the direct method.Identify the individual amounts that would be disclosed in the statement of cash flows where possible.

Definitions:

Federal Government Budget Surplus

Occurs when a government's income exceeds its spending during a fiscal year.

Aggregate Demand

The aggregate need for products and services throughout an economy, specified at a consistent price level and during a certain time.

National Saving

The total saving in an economy, consisting of both private savings by households and businesses, and public savings by the government.

Formal Budget Process

The systematic procedures followed by organizations or governments to estimate revenues, plan expenditures, and manage finances.

Q4: On August 1,a firm assigned $30,000 of

Q19: Total sales for a year are $40,000,which

Q19: An earthquake destroyed the home office building

Q23: See information regarding the four products above.Using

Q48: Which of the following would NOT be

Q50: On December 1,2014,Laramie Company received a $10,000,60-day,6%

Q57: Trade secrets are an example of which

Q60: Arid Company paid $1,704 on June 1,2013,for

Q64: Five percent bonds with a total face

Q76: _ accounting focuses on the development and