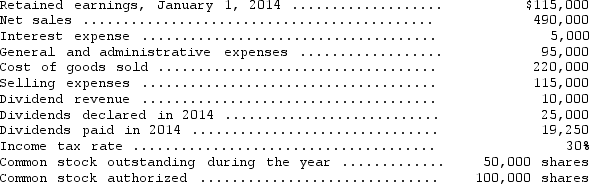

The following data are available from the records of Mandarin,Inc.:

Prepare a single-step income statement and a retained earnings statement for Mandarin,Inc.for the year ended December 31,2014.

Prepare a single-step income statement and a retained earnings statement for Mandarin,Inc.for the year ended December 31,2014.

Definitions:

State Unemployment Taxes

Taxes paid by employers to provide funding for unemployment compensation benefits for workers who have lost their jobs.

FICA Social Security Taxes

Taxes collected under the Federal Insurance Contributions Act (FICA) to fund the Social Security program, which provides benefits for retirees, the disabled, and children of deceased workers.

FICA Medicare Taxes

A specific portion of the FICA tax that is dedicated to funding Medicare, the U.S. government's health insurance program for seniors.

Federal Unemployment Tax

A tax paid by employers to fund the federal government's oversight of the state unemployment insurance programs.

Q1: Robinson Company reported a net loss of

Q11: In the uranium disintegration series:<br>A) the

Q12: Which of the following best describes contributed

Q24: Which of the following is true?<br>A) Companies

Q29: Alonso Company had the following bank reconciliation

Q49: The SEC was given the power to

Q50: The following pretax amounts pertain to the

Q58: The overall objective of financial reporting is

Q58: On December 1,2014,Gomer Corporation exchanged 5,000 shares

Q78: Which of the following measurement attributes is