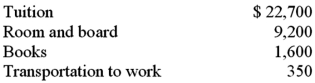

Shelby is working as a paralegal while attending law school at night.This year she has incurred the following expenses associated with school.  What amount can Shelby deduct as an employee business expense if her modified AGI this year is $25,000?

What amount can Shelby deduct as an employee business expense if her modified AGI this year is $25,000?

Definitions:

Output Torque

The rotational force produced by a device or engine, measured at the output shaft.

Trailer Front

The foremost part of a trailer, often designed to connect to the towing vehicle and includes the hitch among other components.

Upper Coupler

The component at the front of a semi-trailer that connects to the fifth wheel of a truck tractor, transferring vertical and horizontal forces between the truck and trailer.

Natural Gas

A fossil fuel consisting mainly of methane, used as an energy source for heating, cooking, and electricity generation.

Q7: Identify the rule dictating that on a

Q8: If a taxpayer places only one asset

Q38: The regulation with the lowest authoritative weight

Q44: Implicit taxes may reduce the benefits of

Q54: Self employed taxpayers can choose between claiming

Q75: Effective tax planning does not require consideration

Q77: For alternative minimum tax purposes,taxpayers are required

Q84: A self-employed taxpayer reports home office expenses

Q88: Pam recently was sickened by eating spoiled

Q89: The standard deduction amount varies by filing