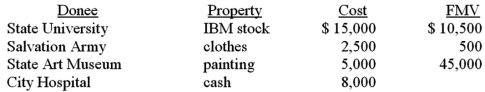

This year Darcy made the following charitable contributions:  Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year.You may assume that both the stock and painting have been owned for 10 years.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year.You may assume that both the stock and painting have been owned for 10 years.

Definitions:

Standard of Living

The level of wealth, comfort, material goods, and necessities available to a person, community, or nation.

Productivity Decline

A decrease in the efficiency with which inputs are converted into outputs, often measured in terms of units produced per labor hour.

Productivity Factors

Refer to the various elements that can influence the efficiency and output of production in an economy, including technology, labor skills, capital goods, and innovation.

Specialized Skill

A high level of proficiency in a specific type of work or activity, which typically requires significant training and experience to develop.

Q1: Which of the following statements concerning tax

Q1: Gambling winnings are included in gross income

Q2: Occasionally bonus depreciation is used as a

Q5: Because he was not necessarily interested in

Q8: The tax return filing requirements for individual

Q12: Frank received the following benefits from his

Q14: Which of the following is a true

Q53: All taxpayers may use the §179 immediate

Q104: All of the following are tests for

Q116: The wage base for which of the