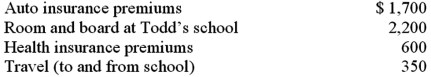

Ned is a head of household with a dependent son,Todd,who is a full-time student.This year Ned made the following expenditures related to Todd's support:  What amount can Ned include in his itemized deductions?

What amount can Ned include in his itemized deductions?

Definitions:

Gainsharing Plans

Employee incentive plans that involve sharing the financial gains from improved productivity, efficiency, or cost-saving measures with employees.

Production Jobs

Positions within a company focused on creating or manufacturing goods, often involving operational or manual labor tasks.

Skill-Based Pay

A compensation strategy that pays employees based on their skills, certifications, or knowledge, rather than their job title or position.

Pay Rate

The amount of money a worker is paid per unit of time or per piece of work completed.

Q5: Josephine is considering taking a 6 month

Q6: John is a self-employed computer consultant who

Q21: A researcher finds that those who have

Q40: Which of the following is not a

Q42: Which of the following statements regarding realized

Q70: Harrison received a qualified dividend.Without knowing any

Q74: After a business meeting with a prospective

Q82: Taxpayers meeting certain home ownership and use

Q102: A taxpayer may qualify for the head

Q103: This year Barney purchased 500 shares of