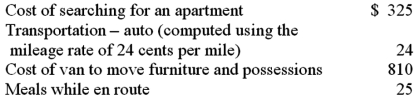

Constance currently commutes 25 miles from her house to her existing part time job in the suburbs.Next week she begins a new full time job in another state,and this job location is 100 miles from her existing home.Because of the additional distance Constance is selling her house,and she has rented an apartment that is only 2 miles from her new job.Constance expects to pay the following moving expenses.  Determine if this move qualifies for a moving expense deduction and calculate the amount (if any) of the deduction.

Determine if this move qualifies for a moving expense deduction and calculate the amount (if any) of the deduction.

Definitions:

Ethics Competency

The ability to understand and apply ethical principles and standards in personal and professional situations.

Legal

Pertaining to the law or the practice of law.

Illegal

Actions or activities that are forbidden by law and subject to legal penalties.

Developing Ideas

The process of creating, refining, and evaluating new concepts or proposals for problems solving, innovation, or improvement.

Q10: Which statement about the international coffee trade

Q13: Having a grandmother who sits on the

Q13: The statute of limitations for IRS assessment

Q30: Brenda has $15,000 in U.S.Series EE saving

Q32: If tax rates are decreasing:<br>A)taxpayers should accelerate

Q48: Lenter LLC placed in service on April

Q51: Circular 230 was issued by:<br>A)AICPA.<br>B)State Boards of

Q56: In addition to the individual income tax,individuals

Q72: Taxpayers may use historical data to determine

Q96: A tax practitioner can avoid IRS penalty