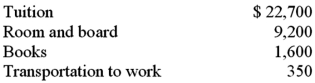

Shelby is working as a paralegal while attending law school at night.This year she has incurred the following expenses associated with school.  What amount can Shelby deduct as an employee business expense if her modified AGI this year is $25,000?

What amount can Shelby deduct as an employee business expense if her modified AGI this year is $25,000?

Definitions:

Real Losses

Actual losses or deficits experienced, typically referring to tangible items or aspects in one's life, such as money, job, or relationships.

Circular Flow

A model that depicts the continuous movement of money, goods and services, and factors of production between producers and consumers, within an economy.

Local Incomes

The amounts of money earned by individuals or households in a specific local area, which can reflect the economic conditions of that region.

Scarcity

The limited availability of resources to meet unlimited wants and needs.

Q4: Early female sociologists such as Jane Addams

Q11: Hank is a sales executive who earned

Q56: The mid-month convention applies to real property

Q58: In certain circumstances,a taxpayer who does not

Q61: Bart,a single taxpayer,has recently retired.This year,he received

Q69: An individual may be considered as a

Q70: Which of the following is a true

Q95: Filing status determines all of the following

Q105: Depending on the year,the original (unextended) due

Q119: Which of the following statements regarding the