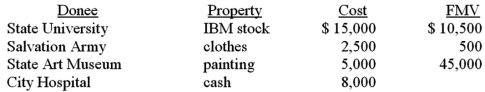

This year Darcy made the following charitable contributions:  Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year.You may assume that both the stock and painting have been owned for 10 years.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year.You may assume that both the stock and painting have been owned for 10 years.

Definitions:

Organelle

Specialized structures within a cell that perform specific functions necessary for the cell's life.

ATP Energy

The primary energy carrier in all living organisms, ATP (adenosine triphosphate) provides energy for various biological processes by releasing energy when it's broken down into ADP (adenosine diphosphate).

Motor Recruitment

Motor recruitment is the process by which muscles increase their force of contraction by activating more motor units.

Acetylcholine

A neurotransmitter and chemical that motor neurons of the nervous system release in order to activate muscles.

Q12: Under the tax law,taxpayers may be subject

Q12: Jones operates an upscale restaurant and he

Q18: Joe Harry,a cash basis taxpayer,owes $20,000 in

Q20: Temporary Regulations have more authoritative weight than

Q24: The conflict perspective considers how laws reinforce

Q29: Tax credits reduce a taxpayer's taxable income

Q38: Which of the following is a true

Q52: The earned income credit is sometimes referred

Q71: The test for a qualifying child includes

Q93: The timing strategy becomes more attractive as