Multiple Choice

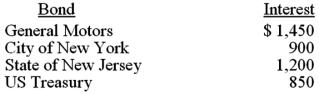

Mike received the following interest payments this year.What amount must Mike include in his gross income (for federal tax purposes) ?

Definitions:

Related Questions

Q3: Clay LLC placed in service machinery and

Q7: Quantitatively,what is the relationship between the AGI

Q14: For regular tax purposes,a taxpayer may deduct

Q19: For fraudulent tax returns,the statute of limitations

Q40: Which of the following is not a

Q43: Lucinda is contemplating a long range planning

Q43: The basis for a personal use asset

Q44: From AGI deductions are commonly referred to

Q78: The concept of present value is an

Q92: When a taxpayer sells an asset,the entire