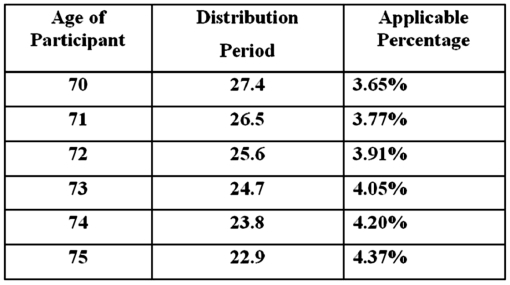

Sean (age 74 at end of 2012) retired five years ago.The balance in his 401(k) account on December 31,2012 was $1,700,000 and the balance in his account on December 31,2013 was $1,800,000.Using the IRS tables below,what is Sean's required minimum distribution for 2013?

Definitions:

Rental Apartments

Living spaces that are available for rent, typically involving a lease agreement between the tenant and the landlord.

Inverse Demand Function

The inverse demand function expresses the price of a good as a function of the quantity demanded, illustrating the relationship between price and quantity from a demand perspective.

Tax Imposed

Refers to charges or levies placed by a government on individuals or entities, influencing economic behavior, revenue collection, and market operations.

Grapefruit

A citrus fruit known for its slightly bitter taste and numerous health benefits, often used in diets and cooking.

Q11: If an individual taxpayer's marginal tax rate

Q19: Compared to the Tax Court method of

Q23: Riley participates in his employer's 401(k) plan.He

Q48: Which of the following is not an

Q76: A sales tax is a common example

Q85: Kevin has the option of investing in

Q87: Taxes influence which of the following decisions?<br>A)business

Q95: Which of the following statements regarding traditional

Q96: A tax practitioner can avoid IRS penalty

Q101: For filing status purposes,the taxpayer's marital status