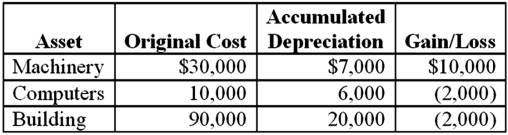

Brandon,an individual,began business four years ago and has never sold a §1231 asset.Brandon owned each of the assets for several years.In the current year,Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 35 percent,what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 35 percent,what effect do the gains and losses have on Brandon's tax liability?

Definitions:

Relationship-based

An approach focusing on building and maintaining positive connections with individuals or entities.

Push-Pull Strategy

A marketing strategy that combines both push tactics, aimed at directly influencing distributors or retailers, and pull tactics, aimed at enticing consumers towards the product.

Sales Forecast

An estimation of the expected sales for a particular period in the future, based on historical data, market analysis, and other factors.

Supply Chain

The interconnected network of entities, including suppliers, manufacturers, and distributors, involved in producing and delivering a product or service to the end consumer.

Q1: Discovery is the process of obtaining information

Q6: Bart is contemplating starting his own business.His

Q18: A court may depart from a precedent

Q18: On February 1,2013 Stephen (who is single)

Q21: All life insurance proceeds given to the

Q50: In a planning context,<br>A)closed facts are preferred

Q56: Basu received a letter from the IRS

Q73: One benefit of a sin tax (e.g.

Q79: What impact does an investment time horizon

Q88: In X8,Erin had the following capital gains