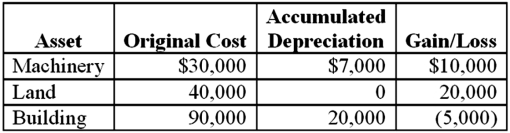

Brandon,an individual,began business four years ago and has sold §1231 assets with $5,000 of losses within the last 5 years.Brandon owned each of the assets for several years.In the current year,Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 35 percent,what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 35 percent,what effect do the gains and losses have on Brandon's tax liability?

Definitions:

Market Value

The going rate for an asset or service to be either bought or sold in a marketplace.

Weighted-average

A method of calculating an average that accounts for the varying significance (weights) of different items in the dataset.

Common Shares

A type of equity security that represents ownership in a corporation, with holders possibly entitled to dividends and voting rights.

Net Income

The ultimate earnings of a corporation after reducing total income by any expenses, taxes, and costs.

Q5: Which of the following statements regarding personal

Q8: Enterprising Markets Coalition (EMC),a political lobbying group,wants

Q12: Which of the following statements regarding Roth

Q14: In 2013,Jessica retired at the age of

Q22: Damages is a remedy at law.

Q25: Constitutional law includes only the U.S.Constitution.

Q34: Refer to Fact Pattern 1-A1.Bellamy's opin?ion is

Q35: Describe the three main loss limitations that

Q44: A simultaneous exchange must take place for

Q85: Kevin has the option of investing in