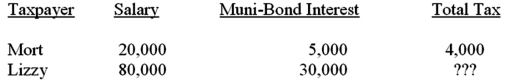

Given the following tax structure,what is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to effective tax rates?  Mort's average tax rate is 20%.

Mort's average tax rate is 20%.

Definitions:

Market System

A market mechanism where the allocation of resources for investment, production, and distribution is driven by the forces of supply and demand, with the pricing of goods and services set freely within the market.

Minimize Cost

The process of finding the most efficient level of production, where the combination of inputs results in the lowest possible cost.

Unit of Output

The basic measure of productivity or product which is generated by a production process, operation, or project.

Competitive Market Economy

A system where market forces govern the production, distribution, and pricing of goods and services, featuring many buyers and sellers and free entry and exit from the market.

Q3: During a trial in Gene's suit against

Q6: Sustainability-economic development that meets the needs of

Q23: Kobe files a suit against Joanna.They meet,and

Q24: The title of a case appears as

Q38: Linear reasoning proceeds from one point to

Q40: Refer to Fact Pattern 3-B1.If Pia files

Q42: Lewis is a state court judge.Like other

Q67: Amy files as a head of household.She

Q77: Which of the following realized gains results

Q101: In addition to raising revenues,specific U.S.taxes may