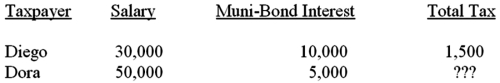

Given the following tax structure,what is the minimum tax that would need to be assessed on Dora to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to be assessed on Dora to make the tax progressive with respect to effective tax rates?

Definitions:

Pre-Move House Hunting

This refers to the process of searching for a new home prior to relocating, often conducted to ensure housing is secured before the move.

Moving Expense

refers to costs incurred for relocating for work purposes, such as transportation and storage of household goods, which under certain conditions, may be deductible.

Lodging

Accommodation provided in a temporary living situation, often associated with hotels, motels, and other temporary housing.

Student Loan Interest

Interest paid on a borrowed loan for education, which may be deductible from taxable income under certain conditions.

Q13: On March 30,2013,Rodger (age 56) was let

Q14: The South Carolina Supreme Court decides the

Q26: Jo files a suit against Lara in

Q28: To prepare for a trial between Large

Q32: Which of the following does not qualify

Q32: Interest earned on U.S.savings bonds is interest

Q44: The estate tax is assessed based on

Q58: What is the character of land used

Q60: One key characteristic of a tax is

Q65: The gain or loss realized is always