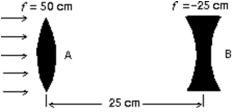

The two lenses shown are illuminated by a beam of parallel light from the left.Lens B is then moved slowly toward lens A.The beam emerging from lens B is:

Definitions:

Efficient Markets Hypothesis

The efficient markets hypothesis is an investment theory that states it is impossible to "beat the market" because stock market efficiency causes existing share prices to always incorporate and reflect all relevant information.

Security Market Line

A representation in finance that shows the relationship between risk and return of a market.

Beta Coefficient

A measure of a stock's volatility in relation to the overall market, indicating its level of risk compared to the market average.

Expected Return

The anticipated profit or loss from an investment, considering all possible outcomes and their probabilities.

Q5: If n<sub>water</sub> = 1.33, what is the

Q15: A ray of light passes through three

Q22: Which of the following is true of

Q23: The behavior of ferromagnetic domains in an

Q25: The widths of the lines produced by

Q34: In Ampere's law, <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6585/.jpg" alt="In Ampere's

Q46: The rainbow seen after a rain shower

Q52: An inductance L, resistance R, and ideal

Q57: The purpose of the mirrors at the

Q65: In a double-slit diffraction experiment the number