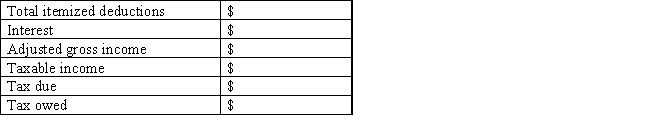

Abraham is a single taxpayer with no dependents.He received $297 in bank interest and $1,500 for an educational expenses deduction.His charitable contributions were $2,000.

Use the information to complete the table below: Wages,tips,and other compensation: $47,513;Social Security withheld based on wages of $47,513;Medicare withheld based on wages of $47,513;federal tax withheld: $4,325;state tax withheld: $2,790.Assume $3,500 per exemption and use the tax rate for the income interval for $32,550 to $78,850 of $4,481.25 + 25% for taxable income over $32,550.

Definitions:

Q4: Which of the following peoples had the

Q10: Jamal has been approved for a $125,000,30-year

Q10: According to medieval Catholic teachings, what was

Q13: Which of the following is NOT a

Q20: The earliest of the Gospels was written<br>A)

Q21: The Punic Wars were waged between Rome

Q22: Maria's employer of 19 years offers a

Q26: Sonja and Jake just got married.They received

Q88: The following are all part of the

Q130: Which statement comparing the right lung of