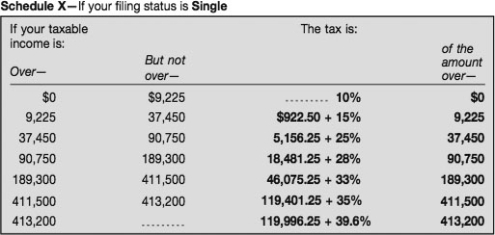

Cody filed as a single taxpayer and determined his taxes to be $19,671.25 using the following tax table.What was his taxable income?

Definitions:

Actual Overhead Cost

The total of all indirect costs that have been incurred in the actual operation of a business.

Factory Overhead

Indirect manufacturing costs not directly linked to specific units produced, including costs for maintenance, utilities, and salaries of supervisory personnel.

Subsidiary Factory Overhead Ledger

A specialized ledger that tracks all the indirect manufacturing costs associated with a company's production process.

Direct Materials

Raw materials and components that are directly used in the production of a product, which can be easily traced and assigned to specific goods.

Q1: William wants to keep his debt-to-income ratio

Q4: Ars nova is the name given to

Q5: Discuss the five landmarks that you consider

Q12: Both El Greco and Velázquez served in

Q18: Luther asserted that the key to salvation

Q27: What is the difference between a tax

Q33: Arnold purchased a $1,300 set of golf

Q39: This information was posted at the end

Q166: Which muscle lies deep to the gastrocnemius?<br>A)

Q169: Identify the gallbladder in the following figure.