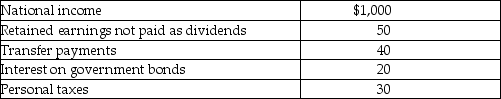

Table 8-27

The components of national income for an economy are represented in Table 8-27 above.All values are in billions of dollars.

The components of national income for an economy are represented in Table 8-27 above.All values are in billions of dollars.

-Refer to Table 8-27.What is the level of disposable personal income for this economy?

Definitions:

Academic Research

The systematic investigation into and study of materials and sources in order to establish facts and reach new conclusions, often conducted in academic settings such as universities and research institutes.

Operational Results

The outcomes and impacts of an organization's operations, often measured in terms of efficiency, effectiveness, and financial performance.

Mediating Structures

Intermediate organizations or networks that facilitate the interaction between individuals and larger institutions, promoting social integration and cohesion.

Rational Acts

Actions or decisions that are made based on logical reasoning and coherent analysis, aiming at maximizing benefits while minimizing costs and risks.

Q1: Over the past several decades there has

Q61: If an economy experiences deflation,the real interest

Q84: The ability to share work and share

Q92: Free trade refers to trade between countries<br>A)that

Q129: A nonmonetary opportunity cost is<br>A)an implicit cost.<br>B)an

Q134: Which of the following is considered a

Q149: During a deflationary period,<br>A)the nominal interest rate

Q174: Refer to Table 8-23.Suppose that a very

Q227: Use the formula for the GDP deflator

Q251: Which of the following would result in