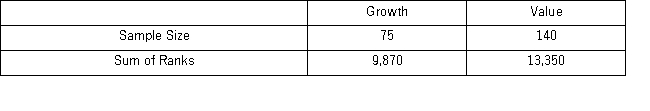

A fund manager wants to know if the annual rate of return is greater for growth stocks (sample 1) than for value stocks (sample 2) .The fund manager collects data on the returns of growth and value funds.Below are the sample sizes and rank sums for the Wilcoxon rank-sum test.  Because both sample sizes are at least 10,W can be assumed to follow a normal distribution with a mean and standard deviation of _____________,respectively.

Because both sample sizes are at least 10,W can be assumed to follow a normal distribution with a mean and standard deviation of _____________,respectively.

Definitions:

Opportunity Cost

The cost of forgoing the next best alternative when making a decision, representing the benefits you could have received by taking an alternative action.

Movieplex

A modern movie theater complex featuring multiple screens within a single venue, allowing for the screening of various films simultaneously.

Coupon

A voucher or code that entitles the holder to a discount off a particular product or service, or a certificate of interest payment on a bond.

Marginal Cost

The expense associated with manufacturing or providing an additional unit of an item or service.

Q8: Tom and Jerry have two tasks to

Q41: For the logarithmic model ln(y)= β<sub>0</sub> +

Q60: A gender is an example of _

Q63: For which of the following models,the formula

Q65: Hugh Wallace has the following information regarding

Q69: Three firms,X,Y,and Z,operate in the same industry,although

Q75: Economies that adopt more open trade policies

Q108: This table shows individual demand schedules for

Q123: The law of demand can be stated

Q136: You decided to take a college accounting