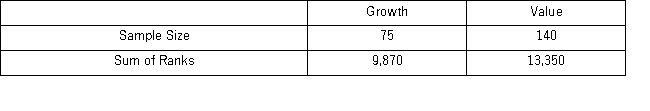

A fund manager wants to know if the annual rate of return is greater for growth stocks (sample 1) than for value stocks (sample 2) .The fund manager collects data on the returns of growth and value funds.Below are the sample sizes and rank sums for the Wilcoxon rank-sum test.  Using the critical value approach and α = 0.01,the appropriate conclusion is ____________.

Using the critical value approach and α = 0.01,the appropriate conclusion is ____________.

Definitions:

Delusions of Grandeur

A false belief in one’s own superiority, greatness, or power, often seen in psychiatric conditions like schizophrenia or bipolar disorder.

Schizophrenia Prevalence

refers to the proportion of the population that is affected by schizophrenia at a given time.

Developing Country

A nation characterized by a lower level of industrialization, economic activity, and human development index compared to developed countries.

Average Prevalence

The typical rate or extent to which a particular disease or condition is found in a population over a specific time period.

Q6: People frequently confuse facts with judgments that

Q17: The Federal Drug Administration slows the pace

Q43: Thirty employed single individuals were randomly selected

Q60: A _ series is obtained by adjusting

Q66: This table shows the demand and supply

Q77: An energy analyst wants to test if

Q89: The income yield from a one-year infrastructure

Q108: Which of the following types of trend

Q119: The city of Burlington is a very

Q125: Suppose that a worker in Country A