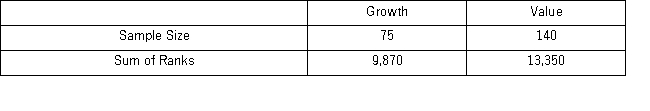

A fund manager wants to know if the annual rate of return is greater for growth stocks (sample 1) than for value stocks (sample 2) .The fund manager collects data on the returns of growth and value funds.Below are the sample sizes and rank sums for the Wilcoxon rank-sum test.  The p-value for the test is __________________.

The p-value for the test is __________________.

Definitions:

Classical Conditioning

A learning process that occurs when two stimuli are repeatedly paired: a response which is initially elicited by the second stimulus is eventually elicited by the first stimulus alone.

Conditioned Response (CR)

The learned reaction or response to a previously neutral stimulus, after the stimulus has been repeatedly presented along with an unconditioned stimulus.

Unconditioned Stimulus (US)

A stimulus that naturally triggers a reflexive response without prior learning.

Extinction

In behavioral psychology, the gradual weakening and disappearance of a conditioned response when the conditioned stimulus is presented without the unconditioned stimulus.

Q17: The consumer price index (CPI)and the producer

Q48: The optimal value of the speed of

Q57: It is believed that the sales volume

Q72: Jackie notices everyone wearing Converse sneakers on

Q79: The following data show the demand for

Q79: The sign test is used to determine

Q82: Noncausal forecasting models are purely time series

Q99: To provide an incentive for villagers to

Q107: In which of the following models does

Q114: Which of the following is not a