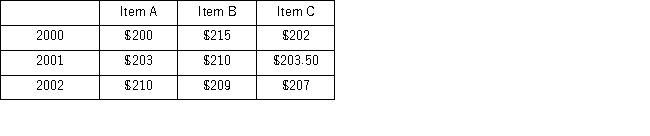

Consider the following data on the prices of three items,A,B,and C,from 2000 through 2002.  If the price of item C in 2002 was 210 instead of 207,which of the following is the unweighted aggregate price index for 2002 for the three items,using 2000 as the base year?

If the price of item C in 2002 was 210 instead of 207,which of the following is the unweighted aggregate price index for 2002 for the three items,using 2000 as the base year?

Definitions:

Beta

Beta is a measure of a stock's volatility in relation to the overall market, indicating the stock's risk compared to the market risk.

Systematic Risk

The risk inherent to the entire market or market segment, representing factors that affect all companies such as economic, political, or social changes.

Diversifiable Risk

The portion of an investment's risk that can be reduced or eliminated through portfolio diversification, also known as unsystematic risk.

Unsystematic Risk

The type of risk that is unique to a specific company or industry, unpredictable and can be mitigated through diversification.

Q13: Thirty employed single individuals were randomly selected

Q24: Which of the following is true about

Q27: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6625/.jpg" alt=" Refer to the

Q45: The following table shows the annual revenues

Q54: SHY (NYSEARCA: SHY)is a 1−3 year Treasury

Q64: For the logistic model,the predicted values of

Q98: A trading magazine wants to determine the

Q100: Prices of crude oil have been steadily

Q120: Which of the following is a positive

Q124: When comparing which of the following trend