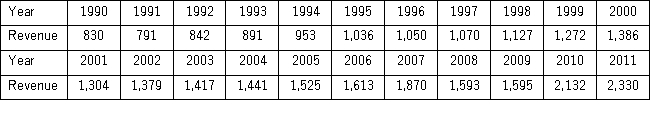

The following table shows the annual revenues (in millions of dollars)of a pharmaceutical company over the period 1990-2011.  The autoregressive models of order 1 and 2,yt = β0 + β1yt - 1 + εt,and yt = β0 + β1yt - 1 + β2yt - 2+ εt,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

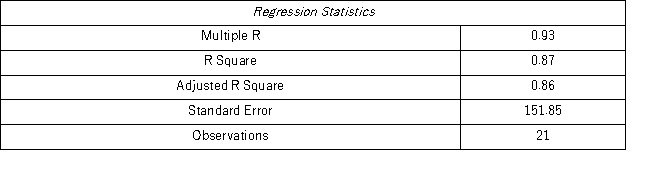

The autoregressive models of order 1 and 2,yt = β0 + β1yt - 1 + εt,and yt = β0 + β1yt - 1 + β2yt - 2+ εt,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

Model AR(1):

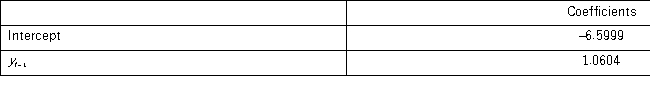

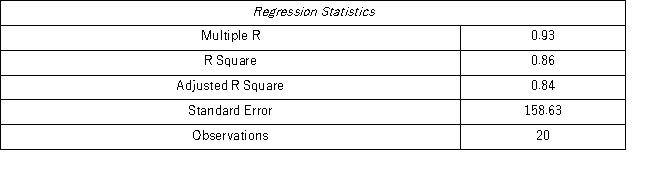

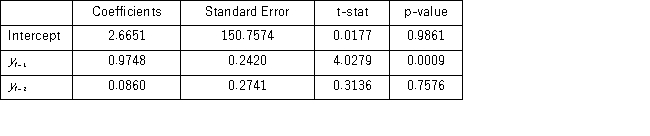

Model AR(2):

Model AR(2):

Using the AR(2)model,find the company revenue forecast for 2012.

Using the AR(2)model,find the company revenue forecast for 2012.

Definitions:

Earnings Per Share

A financial metric that indicates the portion of a company's profit allocated to each outstanding share of common stock, used as an indicator of the company's profitability.

Dividends Per Share

A financial metric that demonstrates the total amount of dividends declared by a company for each share of its outstanding common stock.

Earnings Per Share

A financial metric that divides a company's profit available to common shareholders by the average outstanding shares, indicating the company's profitability.

Price-Earnings Ratio

A metric used to assess a company's value, comparing its current stock price to its earnings per share.

Q1: Using 2008 as the base year,the simple

Q5: In regression,multicollinearity is considered problematic when two

Q16: The following table provides the prices of

Q20: An economist estimates the following model: y

Q24: In the estimation of a multiple regression

Q35: A statistics student is asked to estimate

Q52: Which of the following investment options is

Q60: The value 0.35 of a sample correlation

Q82: Noncausal forecasting models are purely time series

Q94: A dummy variable is also referred to