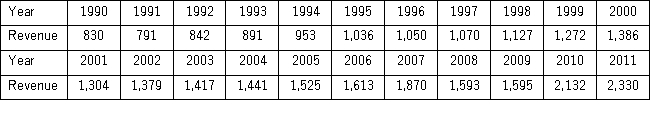

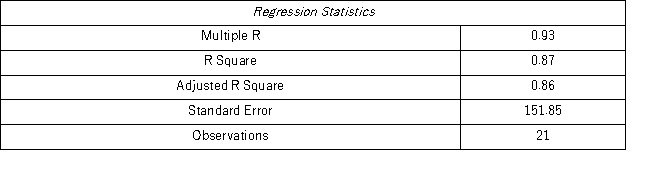

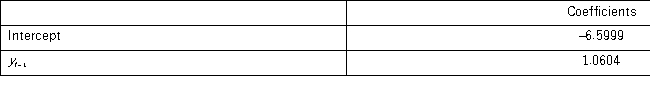

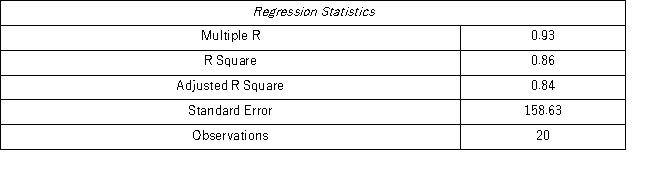

The following table shows the annual revenues (in millions of dollars)of a pharmaceutical company over the period 1990-2011.  The autoregressive models of order 1 and 2,yt = β0 + β1yt - 1 + εt,and yt = β0 + β1yt - 1 + β2yt - 2+ εt,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

The autoregressive models of order 1 and 2,yt = β0 + β1yt - 1 + εt,and yt = β0 + β1yt - 1 + β2yt - 2+ εt,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

Model AR(1):

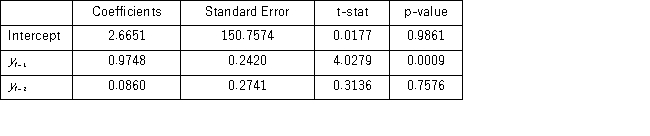

Model AR(2):

Model AR(2):

Using the AR(2)model,find the company revenue forecast for 2012.

Using the AR(2)model,find the company revenue forecast for 2012.

Definitions:

Interest Rate

The percentage of a sum of money charged by a lender to a borrower for the use of the money.

APR

Annual Percentage Rate, the yearly interest rate charged to borrowers, including fees and other costs, providing a complete picture of the loan's cost.

Periodic Rate

The interest rate for a specific period of time, often related to credit cards or loans, which can be monthly, quarterly, etc.

APR

Annual Percentage Rate, a measure of the cost of credit, expressing the yearly interest rate.

Q23: A career counselor is comparing the annual

Q30: For the log-log model ln(y)= β<sub>0</sub> +

Q56: Kim Back invested $20,000 one year in

Q60: A _ series is obtained by adjusting

Q64: A marketing analyst wants to examine the

Q90: Which of the following factors refers to

Q108: The following portion of regression results was

Q110: A scatterplot can help determine if two

Q112: When a time series is analyzed by

Q139: Thomas Malthus was an early nineteenth-century economist