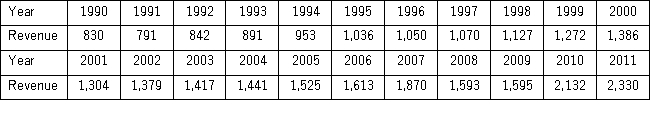

The following table shows the annual revenues (in millions of dollars)of a pharmaceutical company over the period 1990-2011.  The autoregressive models of order 1 and 2,yt = β0 + β1yt - 1 + εt,and yt = β0 + β1yt - 1 + β2yt - 2 + εt,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

The autoregressive models of order 1 and 2,yt = β0 + β1yt - 1 + εt,and yt = β0 + β1yt - 1 + β2yt - 2 + εt,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

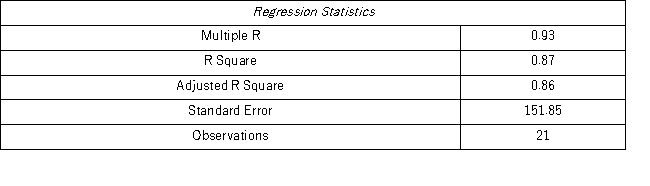

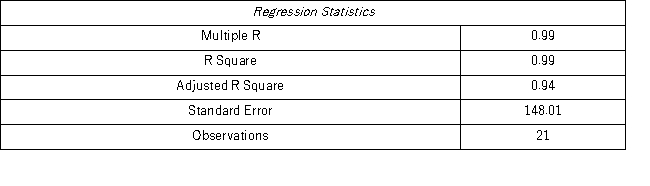

Model AR(1):

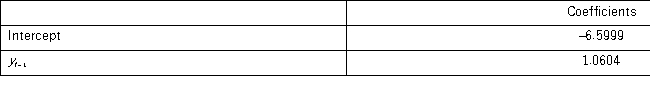

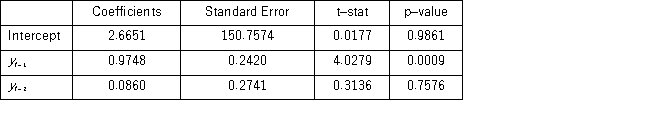

Model AR(2):

Model AR(2):

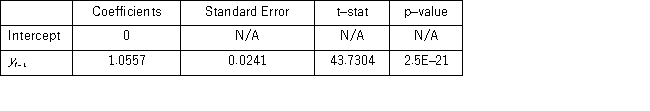

When for AR(1),H0: β0 = 0 is tested against HA: β0 ≠ 0,the p-value of this t test shown by Excel output is 0.9590.This could suggest that the model yt = β1yt-1 + εt might be an alternative to the AR(1)model yt = β0 + β1yt-1 + εt.Excel partial output for this simplified model is as follows:

When for AR(1),H0: β0 = 0 is tested against HA: β0 ≠ 0,the p-value of this t test shown by Excel output is 0.9590.This could suggest that the model yt = β1yt-1 + εt might be an alternative to the AR(1)model yt = β0 + β1yt-1 + εt.Excel partial output for this simplified model is as follows:

Find the revenue forecast for 2012 through the use of yt = β1yt-1 + εt.

Find the revenue forecast for 2012 through the use of yt = β1yt-1 + εt.

Definitions:

Accounts Receivable Turnover

A financial ratio indicating how efficiently a company collects cash from credit sales by measuring the number of times receivables are collected over a period.

Inventory Turnover

An index that reveals the number of times a business's stock is sold and restocked during a specific period, showcasing how efficiently inventory is managed.

Total Current Assets

Assets of a company that are expected to be used or converted to cash within one year.

Debt/Equity Ratio

Determination of a firm's borrowing dependency, achieved by dividing its liabilities by its shareholder's equity.

Q9: To examine the differences between salaries of

Q22: Having a goal that does not include

Q65: Hugh Wallace has the following information regarding

Q75: The numerical measure that gauges dispersion from

Q78: Consider the following information about the price

Q88: Compared to the sample correlation coefficient,the sample

Q95: What is the name of the variable

Q99: An economist examines the relationship between the

Q110: In forecasting methods,the mean square error (MSE)is

Q128: When estimating <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg" alt="When estimating