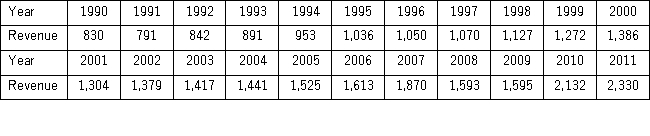

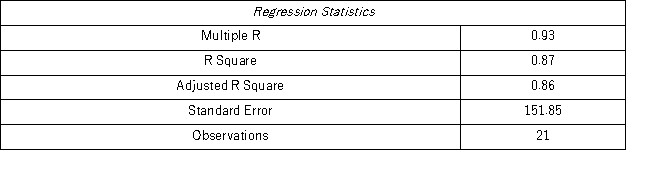

The following table shows the annual revenues (in millions of dollars)of a pharmaceutical company over the period 1990-2011.  The autoregressive models of order 1 and 2,yt = β0 + β1yt - 1 + εt,and yt = β0 + β1yt - 1 + β2yt - 2 + εt,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

The autoregressive models of order 1 and 2,yt = β0 + β1yt - 1 + εt,and yt = β0 + β1yt - 1 + β2yt - 2 + εt,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

Model AR(1):

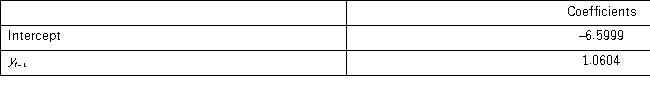

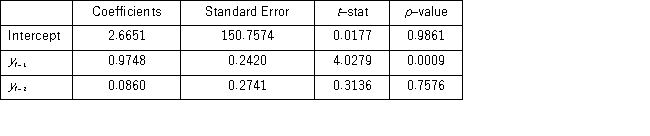

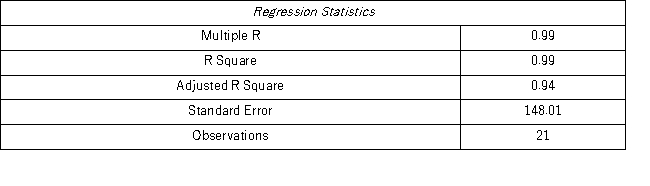

Model AR(2):

Model AR(2):

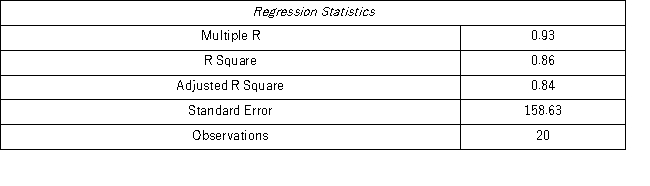

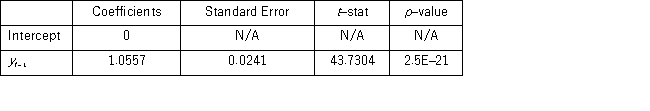

When for AR(1),H0: β0 = 0 is tested against HA: β0 ≠ 0,the p-value of this t test shown by Excel output is 0.9590.This could suggest that the model yt = β1yt-1 + εt might be an alternative to the AR(1)model yt = β0 + β1yt-1 + εt.Excel partial output for this simplified model is as follows:

When for AR(1),H0: β0 = 0 is tested against HA: β0 ≠ 0,the p-value of this t test shown by Excel output is 0.9590.This could suggest that the model yt = β1yt-1 + εt might be an alternative to the AR(1)model yt = β0 + β1yt-1 + εt.Excel partial output for this simplified model is as follows:

(Use Regression in Data Analysis of Excel. )

(Use Regression in Data Analysis of Excel. )

Compare the autoregressive models yt = β0 + β1yt-1 + εt;yt = β0 + β1yt-1 + β2yt-2 + εt,andyt = β1yt-1 + εt,through the use of MSE and MAD.

Definitions:

Course of Action

A plan or strategy designed to achieve a particular goal or to solve a specific problem.

Critical Decision

A significant choice or judgment that can have a profound impact on the direction or outcome of a process or project.

CAD System

Computer-Aided Design (CAD) System refers to software used by engineers, architects, and designers to create precision drawings or technical illustrations.

Product Development

The process of conceptualizing, designing, creating, and bringing a new product or service to the market.

Q6: In the regression equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg" alt="In

Q46: All criteria used for selecting the best

Q54: Given the following portion of regression results,which

Q63: Hardee's announces "buy one get one free"

Q84: A pawn shop claims to sell used

Q90: For the Wilcoxon rank-sum test with the

Q93: A Paasche index with updated weights _.<br>A)

Q102: A researcher gathers data on 25 households

Q106: Consider the regression equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg" alt="Consider

Q123: The accompanying table shows the regression results