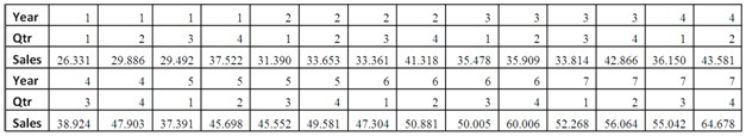

Quarterly sales of a department store for the last seven years are given in the following table.

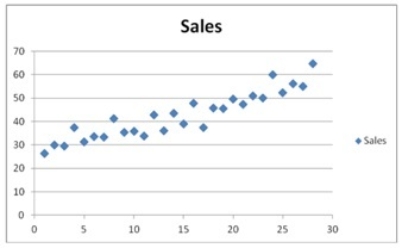

The Excel scatterplot shown indicates that the quarterly sales have an increasing trend and seasonality.Therefore,the linear regression model,Sales = β0 + β1Qtr1 + β2Qtr2 + β3Qtr3 + β4t + ε,with three seasonal dummy variables Qtr1,Qtr2,and Qtr3,and the decomposition method are proposed to make sales forecasts.For the regression model,the following Excel partial output is available.

The Excel scatterplot shown indicates that the quarterly sales have an increasing trend and seasonality.Therefore,the linear regression model,Sales = β0 + β1Qtr1 + β2Qtr2 + β3Qtr3 + β4t + ε,with three seasonal dummy variables Qtr1,Qtr2,and Qtr3,and the decomposition method are proposed to make sales forecasts.For the regression model,the following Excel partial output is available.  (Use Excel or statistical software. )Using the decomposition method:

(Use Excel or statistical software. )Using the decomposition method:

a.Compute the adjusted seasonal indices for the four quarters.

b.Find the linear trend equation for the seasonally adjusted quarterly sales.

c.Make the sales forecasts for the first and fourth quarter of Year 8.

Definitions:

Debt-to-Assets Ratio

A metric showing the proportion of a company's total assets financed through debt, providing insight into the company's financial leverage.

Flotation Costs

The costs associated with issuing new securities, including underwriting fees, legal fees, and registration fees.

After-Tax Cash Inflows

After-tax cash inflows represent the net cash a company receives from its operations, investments, or financial activities, after all taxes have been deducted.

Flotation Cost

The total costs a company incurs when it issues new securities, including underwriting fees, legal fees, and registration fees.

Q15: If you generate a new idea that

Q15: Typically,the sales volume declines with an increase

Q20: Which of the following is one of

Q39: Hugh Wallace has the following information regarding

Q42: The following table includes the information about

Q44: If the nominal rate of return is

Q53: What does a positive value for price

Q70: Each point in the scatterplot represents one

Q83: When the forecasting method of seasonal dummy

Q83: Joanna Williams purchased a one-year Treasury bill