A researcher wants to examine how the remaining balance on $100,000 loans taken 10 to 20 years ago depends on whether the loan was a prime or subprime loan.He collected a sample of 25 prime loans and 25 subprime loans and recorded the data in the following variables: Balance = the remaining amount of loan to be paid off (in $) ,

Time = the time elapsed from taking the loan,

Prime = a dummy variable assuming 1 for prime loans,and 0 for subprime loans.

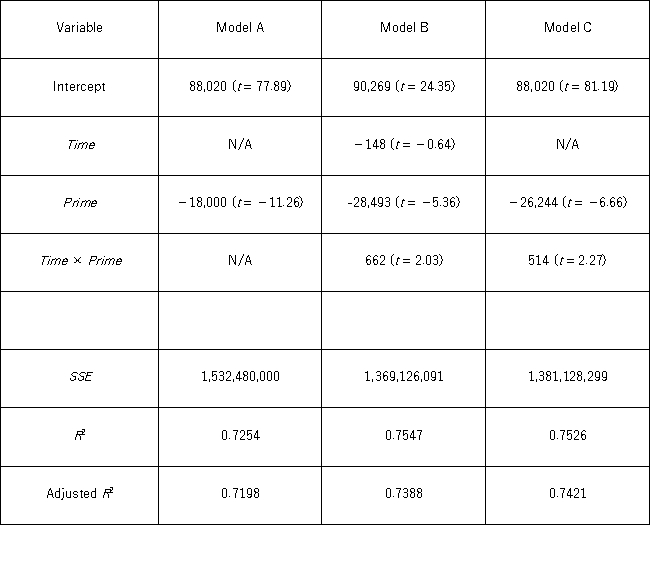

The regression results obtained for the models:

Model A: Balance = β0 + β1Prime + ε

Model B: Balance = β0 + β1Time + β2Prime + β3Time × Prime + ε

Model C: Balance = β0 + β1Prime + β2Time × Prime + ε,

Are summarized in the following table.  Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Using Model B,what is the null hypothesis for testing the joint significance of the variable Time and the interaction variable Time × Prime?

Definitions:

Security Market Line

A representation in finance that shows the expected return of investments at different levels of risk, based on the capital asset pricing model (CAPM).

Beta

A gauge of the variability of a stock's value relative to the comprehensive market.

Market Average

A statistical measure that represents the overall market or a specific segment of it, commonly used to track market performance.

Return

The profit or deficit experienced on an investment during a given period, represented as a percentage of the original investment's value.

Q4: One-way ANOVA analyzes the effect of one

Q9: If the average price for gasoline in

Q35: A bank manager is interested in assigning

Q62: For the logarithmic model y = β<sub>0</sub>

Q76: When testing r linear restrictions imposed on

Q90: For the Wilcoxon rank-sum test with the

Q107: A sociologist wishes to study the relationship

Q108: Which actor in the simplified circular flow

Q121: The accompanying table shows the regression results

Q134: Data was collected for 30 professional tennis