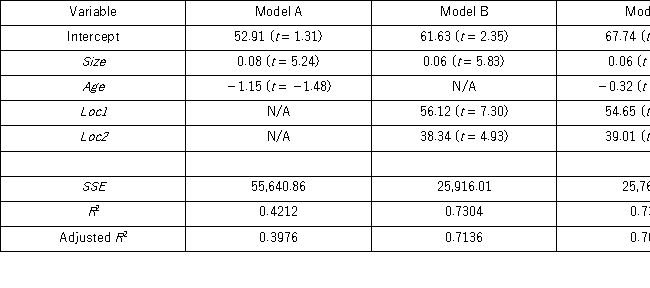

A realtor wants to predict and compare the prices of homes in three neighboring locations.She considers the following linear models:

Model A: Price = β0 + β1Size + β2Age + ε

Model B: Price = β0 + β1 Size + β3 Loc1 + β4 Loc2 + ε

Model C: Price = β0 + β1Size + β2Age + β3 Loc1 + β4 Loc2 +ε

where,

Price = the price of a home (in $1,000s)

Size = the square footage (in sq.feet)

Loc1 = a dummy variable taking on 1 for Location 1,and 0 otherwise

Loc2 = a dummy variable taking on 1 for Location 2,and 0 otherwise

After collecting data on 52 sales and applying regression,her findings were summarized in the following table.  Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Using Model B,compute the test statistic for testing the joint significance of the two dummy variables Loc1 and Loc2.

Definitions:

Capital Lease Disclosures

Financial reporting requirements that detail the specifics of lease agreements classified as capital leases, including future payment obligations and interest expenses.

Lessees

Parties that obtain the right to use an asset for a specific period in exchange for payment, under a lease agreement.

Implicit Interest Rate

The rate that equates the present value of lease payments and any unguaranteed residual value to the fair value of the leased asset.

Income Report

An income report, commonly known as an income statement, is a financial document that shows a company's revenue, expenses, and net income over a specific period.

Q4: Consider the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg" alt="Consider

Q16: A real estate analyst believes that the

Q24: The log-log and the _ models can

Q27: For the Spearman rank correlation test we

Q27: Amy Peterson's annual salary when she started

Q33: Over the past 30 years,the sample standard

Q62: For the logarithmic model y = β<sub>0</sub>

Q67: A university advisor wants to determine if

Q81: A realtor wants to predict and compare

Q109: Consider the following information about the price