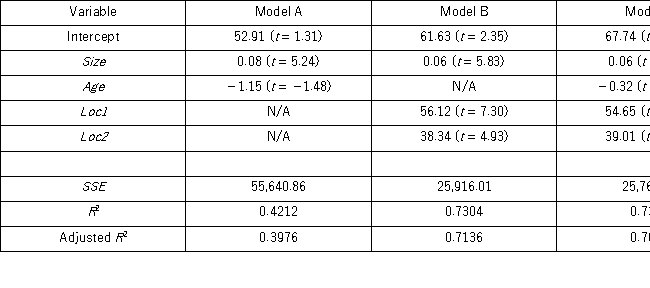

A realtor wants to predict and compare the prices of homes in three neighboring locations.She considers the following linear models:

Model A: Price = β0 + β1Size + β2Age + ε

Model B: Price = β0 + β1 Size + β3 Loc1 + β4 Loc2 + ε

Model C: Price = β0 + β1Size + β2Age + β3 Loc1 + β4 Loc2 +ε

where,

Price = the price of a home (in $1,000s)

Size = the square footage (in sq.feet)

Loc1 = a dummy variable taking on 1 for Location 1,and 0 otherwise

Loc2 = a dummy variable taking on 1 for Location 2,and 0 otherwise

After collecting data on 52 sales and applying regression,her findings were summarized in the following table.  Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Note: The values of relevant test statistics are shown in parentheses below the estimated coefficients.

Using Model B,compute the predicted difference between the price of homes with the same square footage located in Location 2 and Location 3.

Definitions:

Current Liabilities

Short-term financial obligations that are due within one year or within a normal operating cycle.

Stockholders' Equity

Represents the equity stake currently held by all shareholders of a company, calculated as the total assets minus total liabilities.

Working Capital

The distinction between an organization's immediate assets and liabilities, showing its short-term fiscal well-being and effectiveness in operations.

Plant and Equipment

Long-term tangible assets used in the operation of a business, not intended for sale.

Q9: To examine the differences between salaries of

Q28: The value 0.75 of a sample correlation

Q38: The following data,with the corresponding Excel scatterplot,show

Q40: The following table shows the annual revenues

Q53: A manager at a local bank analyzed

Q90: For the model y = β<sub>0 </sub>+

Q93: To examine the differences between salaries of

Q94: A dummy variable is also referred to

Q117: A real estate analyst believes that the

Q133: A manager at a local bank analyzed