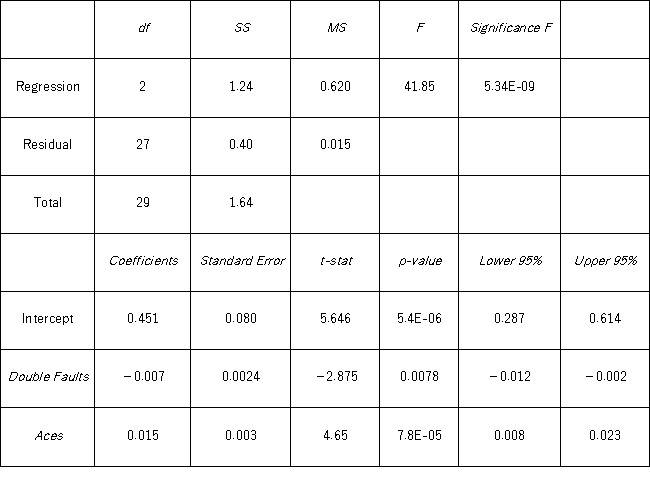

A sports analyst wants to exam the factors that may influence a tennis player's chances of winning.Over four tournaments,he collects data on 30 tennis players and estimates the following model: Win = β0 + β1 Double Faults + β2Aces + ε,where Win is the proportion of winning,Double Faults is the percentage of double faults made,and Aces is the number of aces.A portion of the regression results are shown in the accompanying table.  When testing whether the explanatory variables jointly influence the response variable,the null hypothesis is ______________________.

When testing whether the explanatory variables jointly influence the response variable,the null hypothesis is ______________________.

Definitions:

Trading Securities

Trading securities are investments in financial instruments that a company intends to sell in the short term with the aim of generating profit from short-term price fluctuations.

Available-For-Sale Securities

Available-for-sale securities are financial assets that a company intends to sell but is not obligated to do so, classified as neither held-to-maturity nor trading securities.

Held-To-Maturity Securities

Debt securities that a company intends and is able to hold until they mature.

Equity Method

An accounting method used to assess the investments made by a company in other companies, where the investment is significant but not controlling.

Q2: Becky owns a diner and is concerned

Q20: Consider the following simple linear regression model:

Q29: The quadratic and logarithmic models,y = β<sub>0</sub>

Q51: A career counselor wants to understand if

Q70: A bank manager is interested in assigning

Q73: Given the following portion of regression results,which

Q74: Quantitative variables assume meaningful _,where as qualitative

Q76: With the method of seasonal dummy variables,we

Q86: When estimating y = β<sub>0</sub> + β<sub>1</sub>x<sub>1</sub>

Q107: A researcher wants to examine how the