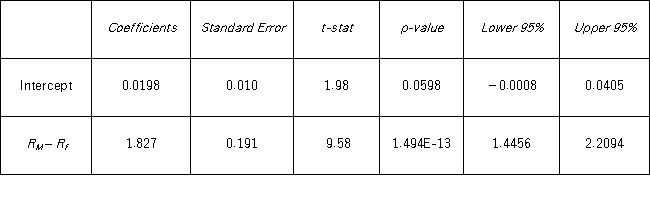

Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the CAPM model for Tiffany's return.  When testing whether the beta coefficient is significantly greater than one,the value of the test statistic is ____.

When testing whether the beta coefficient is significantly greater than one,the value of the test statistic is ____.

Definitions:

Product Price

The amount of money charged for a product or service, determined by factors such as cost of production, market demand, and competition.

Curve Steepness

The rate at which the slope of a curve increases or decreases, often used in economics to describe the sensitivity of one variable to another.

Maximizes Profits

The process or strategy whereby a firm adjusts its production and pricing to achieve the highest possible profit.

Average Total Cost

Average total cost is calculated by dividing the total cost of producing a given output level by the quantity of output, reflecting the average cost per unit of output produced.

Q15: The following table shows numerical summaries of

Q22: In the following table,likely voters' preferences of

Q32: The following data for five years of

Q43: A manufacturer of flash drives for data

Q56: It is believed that the sales volume

Q66: The following data show the demand for

Q86: Quarterly sales of a department store for

Q94: Smoothing techniques are suitable for use when

Q112: A travel agent wants to determine if

Q120: In the following table,likely voters' preferences of