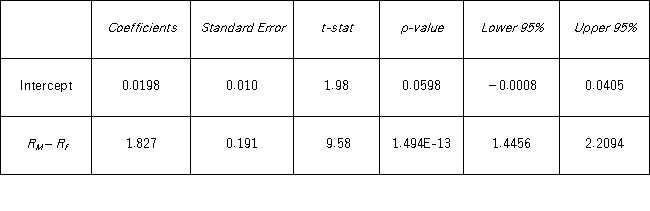

Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the CAPM model for Tiffany's return.  When testing whether there are abnormal returns,the conclusion to the test is at the 5% significance level is to ___________________________________________________.

When testing whether there are abnormal returns,the conclusion to the test is at the 5% significance level is to ___________________________________________________.

Definitions:

Raw Material

The basic substances or components that are processed and transformed into finished goods in manufacturing.

Fixed Overhead Volume Variance

The difference between the budgeted and actual volume of production, multiplied by the fixed overhead rate, indicating how fixed costs are allocated over different levels of output.

Fixed Overhead Budget Variance

This term refers to the difference between the budgeted fixed overhead costs and the actual fixed overhead costs incurred.

Standard Fixed Manufacturing Overhead Rate

The predetermined rate used to apply fixed manufacturing overhead to products, based on an estimate of total fixed manufacturing costs and an allocation basis.

Q1: For the goodness-of-fit test for normality,the null

Q20: Fizzco,a beverage manufacturing company,is interested in determining

Q23: Given the estimated model <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4266/.jpg" alt="Given

Q28: For the Jarque-Bera test for normality,the null

Q33: Over the past 30 years,the sample standard

Q47: If a sample of size n is

Q70: Which of the following is the value

Q98: Thirty employed single individuals were randomly selected

Q120: A researcher analyzes the factors that may

Q131: The following table shows the number of