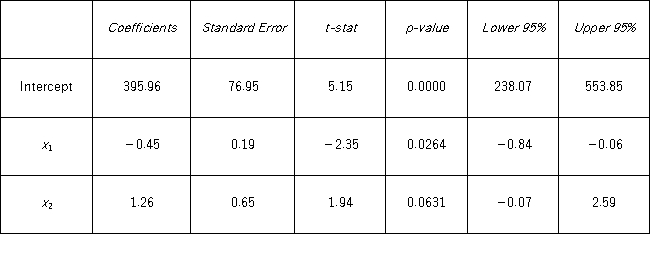

When estimating a multiple regression model based on 30 observations,the following results were obtained.  a.Specify the hypotheses to determine whether x1 is linearly related to y.At the 5% significance level,use the p-value approach to complete the test.Are x1 andy linearly related?

a.Specify the hypotheses to determine whether x1 is linearly related to y.At the 5% significance level,use the p-value approach to complete the test.Are x1 andy linearly related?

b.Construct the 95% confidence interval for β2.Using this confidence interval,is x2 significant in explaining y? Explain.

c.At the 5% significance level,can you conclude that β1 differs from −1? Show the relevant steps of the appropriate hypothesis test.

Definitions:

Call Option

A financial agreement that allows the purchaser the option, without the requirement, to purchase a stock, bond, commodity, or different asset at an agreed-upon price during a predetermined timeframe.

Expiration

The predetermined date on which an options or futures contract becomes void and the right to exercise it ceases.

Intrinsic Value

The inherent or true value of an asset, investment, or company, based on fundamental analysis, excluding market speculation.

Exercise Price

The predetermined price at which the holder of an option can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset.

Q6: The manager of a video library would

Q21: A real estate analyst believes that the

Q21: The difference between the two sample means

Q21: The _ regression model allows us to

Q23: The population variance is one of the

Q97: Which of the following components does not

Q98: Find the value x for which<br>a.P( <img

Q103: Simple linear regression includes more than one

Q105: A marketing analyst wants to examine the

Q114: Serial correlation is typically observed in _.<br>A)