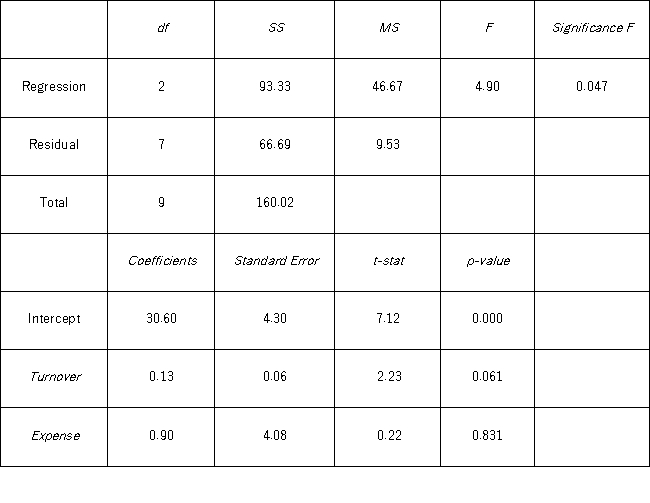

An investment analyst wants to examine the relationship between a mutual fund's return,its turnover rate,and its expense ratio.She randomly selects 10 mutual funds and estimates: Return = β0 + β1Turnover + β2Expense + ε,where Return is the average five-year return (in %),Turnover is the annual holdings turnover (in %),Expense is the annual expense ratio (in %),and ε is the random error component.A portion of the regression results is shown in the accompanying table.  a.At the 10% significance level,are the explanatory variables jointly significant in explaining Return? Explain.

a.At the 10% significance level,are the explanatory variables jointly significant in explaining Return? Explain.

b.At the 10% significance level,is each explanatory variable individually significant in explaining Return? Explain.

Definitions:

Local Monopoly

A condition where a single firm has control over a market or product within a specific geographical area.

Price Discriminate

A strategy where a seller charges different prices for the same product or service to different customers, based on factors like willingness to pay, location, or purchase volume.

Economic Profit

The financial measurement between a company's aggregate earnings and its total costs, covering both explicit and hidden charges.

Output Level

The quantity of goods or services produced by a firm or economy in a certain period.

Q6: Assume you ran a multiple regression to

Q8: Amie Jackson,a manager at Sigma travel services,makes

Q13: AutoTrader.com would like to test if a

Q79: A researcher analyzes the factors that may

Q83: The correlation coefficient could be considered as

Q88: Based on quarterly data collected over the

Q97: In regression,the predicted values concerning y are

Q101: Consider the following simple linear regression model:

Q103: Simple linear regression includes more than one

Q105: A university has six colleges and takes