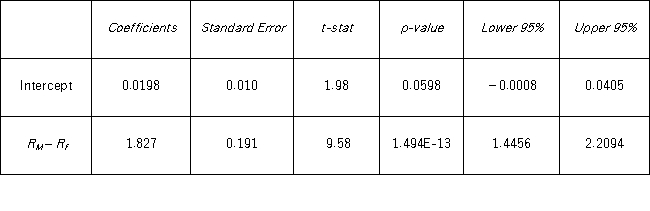

Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the CAPM model for Tiffany's return.  To determine whether abnormal returns exist,which of the following competing hypotheses do you set up?

To determine whether abnormal returns exist,which of the following competing hypotheses do you set up?

Definitions:

Hidden Costs

Expenses that are not immediately apparent at the time of purchase but become evident later in the use or maintenance of an item.

Feigned Scarcity Technique

A marketing strategy where a company or seller creates an artificial sense of scarcity for a product or service to increase demand.

Reciprocity Norm

A social norm that involves an expectation that people will respond to each other in kind, returning benefits for benefits.

Social Influence

The effect that the words, actions, or mere presence of other people have on our thoughts, feelings, attitudes, or behavior.

Q14: Many nonlinear regression models can be studied

Q21: The following table shows the annual returns

Q22: A researcher analyzes the relationship between amusement

Q50: Covariance can be used to determine if

Q66: One of the assumptions of regression analysis

Q68: A binary choice model can be used,for

Q88: A researcher wants to examine how the

Q98: Find the value x for which<br>a.P( <img

Q107: Find the value x for which<br>a.P( <img

Q118: Consider the following regression results based on