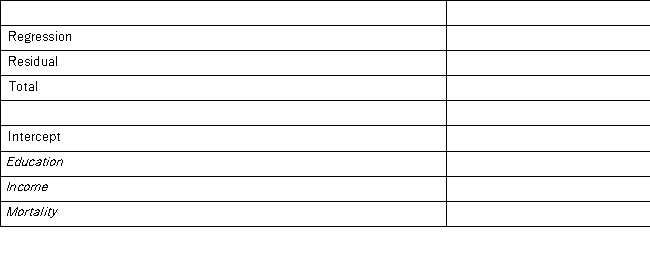

A sociologist examines the relationship between the poverty rate and several socioeconomic factors.For the 50 states and the District of Columbia (n = 51) ,he collects data on the poverty rate (y,in %) ,the percent of the population with at least a high school education (x1) ,median income (x2,in $1000s) ,and the mortality rate per 1,000 residents (x3) .He estimates the following model as y = β0 + β1 Education + β2 Income + β3 Mortality + ε.The following ANOVA table shows a portion of the regression results.  Which of the following is the value of the mean square error, (MSE) ?

Which of the following is the value of the mean square error, (MSE) ?

Definitions:

Parasympathetic

Pertaining to the part of the autonomic nervous system responsible for controlling bodily functions when at rest, such as slowing the heart rate and stimulating digestive activities.

Aroused

A state of being awake and reactive to stimuli; can also refer to a heightened state of physical or emotional excitement.

Central Nervous

Refers to the central nervous system, which consists of the brain and spinal cord, serving as the primary processing center for nervous system functions.

Peripheral Nervous

Part of the nervous system outside the brain and spinal cord, including nerves and ganglia, responsible for relaying information to and from the body to the central nervous system.

Q10: An marketing analyst wants to examine the

Q30: A veterinarian wants to know if pit

Q33: Suppose that we have a qualitative variable

Q55: When some explanatory variables of a regression

Q79: A researcher analyzes the factors that may

Q79: Annual growth rates for individual firms in

Q83: A bank is trying to determine which

Q83: In a multiple regression based on 30

Q93: A veterinarian wants to know if pit

Q119: In the following table,individuals are cross-classified by