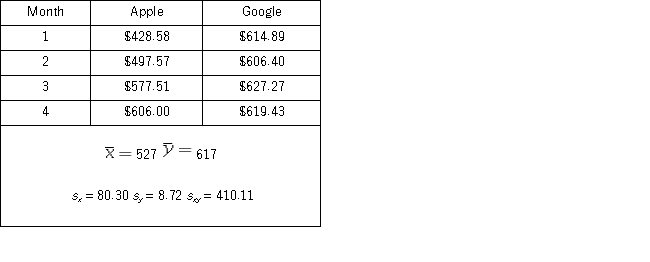

A portfolio manager is interested in reducing the risk of a particular portfolio by including assets that have little,if any,correlation.He wonders whether the stock prices for the firms Apple and Google are correlated.As a very preliminary step,he collects the monthly closing stock price for each firm from January 2012 to April 2012.  a.Compute the sample correlation coefficient.

a.Compute the sample correlation coefficient.

b.Specify the competing hypotheses in order to determine whether the stock prices are correlated.

c.Calculate the value of the test statistic and approximate the corresponding p-value.

d.At the 5% significance level,what is the conclusion to the test? Explain.

Definitions:

Pitting Edema

A condition where pressure applied to the skin leaves an indentation, often indicating fluid accumulation in tissues.

Dextrose

A simple sugar that is chemically identical to glucose, used medically as an energy source and in treating hypoglycemia.

Nasogastric Suction

A medical procedure where a tube is inserted through the nose into the stomach to remove its contents.

Potassium Supplement

A dietary supplement taken to increase potassium levels in individuals with a deficiency or to maintain adequate levels of potassium in the body.

Q2: According to the Center for Disease Control

Q34: Thirty employed single individuals were randomly selected

Q41: Which of the following is the pooled

Q60: A one-tailed hypothesis test of the population

Q72: Consider the following simple linear regression model:

Q88: The accompanying table shows the regression results

Q91: The following table shows the distribution of

Q100: The values taken from a normally distributed

Q105: Prices of crude oil have been steadily

Q108: The following frequency distribution shows the monthly