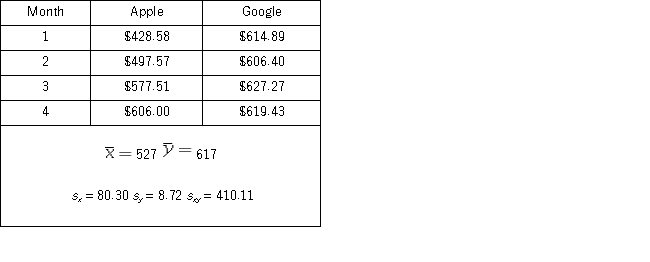

A portfolio manager is interested in reducing the risk of a particular portfolio by including assets that have little,if any,correlation.He wonders whether the stock prices for the firms Apple and Google are correlated.As a very preliminary step,he collects the monthly closing stock price for each firm from January 2012 to April 2012.  a.Compute the sample correlation coefficient.

a.Compute the sample correlation coefficient.

b.Specify the competing hypotheses in order to determine whether the stock prices are correlated.

c.Calculate the value of the test statistic and approximate the corresponding p-value.

d.At the 5% significance level,what is the conclusion to the test? Explain.

Definitions:

Finished Product

The final version of a product that has undergone all stages of production and is ready for sale or distribution.

HMIs

Human Machine Interfaces, devices or software allowing interaction between humans and machines, typically used in industrial environments.

Diagnose

The process of identifying, deducing, and addressing issues within a system, machine, or piece of equipment.

Q18: The formula for the confidence interval of

Q35: Fisher's LSD method is applied when the

Q40: Costco sells paperback books in their retail

Q40: Thirty employed single individuals were randomly selected

Q47: Psychology students want to determine if there

Q66: The relationship between the response variable and

Q67: A researcher wants to examine how the

Q81: A fund manager wants to know if

Q97: The administrator of a college is concerned

Q122: Consider the following sample regression equation <img