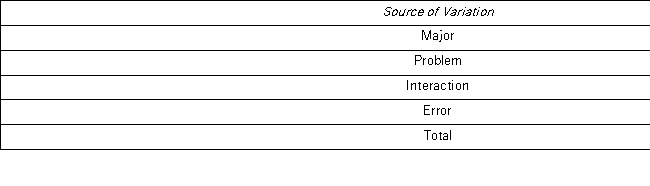

Psychology students want to determine if there are differences between the ability of business majors and science majors to solve various types of analytic problems.They conduct an experiment and record the amount of time it takes to complete each analytic problem.The following two-way ANOVA table summarizes their findings.  At the 5% significance level,the conclusion for the hypothesis test about the interaction term is ______.

At the 5% significance level,the conclusion for the hypothesis test about the interaction term is ______.

Definitions:

Cash Flow Hedge

A financial instrument intended to offset potential losses or gains that could be incurred by future cash flows, acting as a buffer against currency, interest rate, or commodity price changes.

Forward Exchange Contract

A financial derivative that locks in the exchange rate at which a currency can be bought or sold on a future date.

Fair Value Hedge

A hedge of the exposure to changes in fair value of a recognized asset or liability or an unrecognized firm commitment, or an identified portion of such an asset, liability, or firm commitment, that is attributable to a particular risk and could affect profit or loss.

Local Currency Units

The monetary units issued by a country's central bank, used as the standard for financial transactions within that country.

Q18: The formula for the confidence interval of

Q26: The logarithmic model is especially attractive when

Q40: The following table shows the distribution of

Q45: One-way ANOVA analyzes the effect of one

Q47: For a given sample size,any attempt to

Q52: The following data for five years of

Q63: The student senate at a local university

Q83: A company decided to test the hypothesis

Q106: Which of the following answers represents the

Q111: If independent samples of size n<sub>1</sub> and