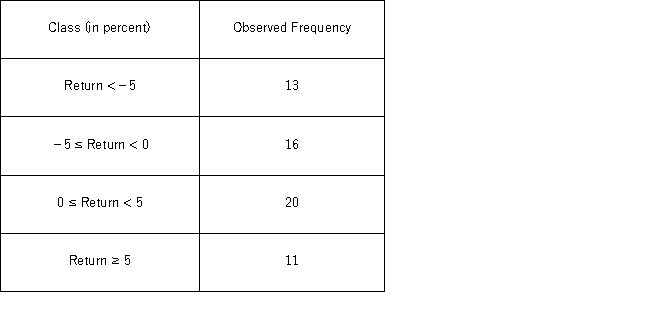

The following frequency distribution shows the monthly stock returns for Home Depot for the years 2003 through 2007.  Over the time period,the following summary statistics are provided: Mean = 0.31%,Standard deviation = 6.49%,Skewness = 0.15,and Kurtosis = 0.38.The probability that the return is less than −5% if the return is normally distributed is _______.

Over the time period,the following summary statistics are provided: Mean = 0.31%,Standard deviation = 6.49%,Skewness = 0.15,and Kurtosis = 0.38.The probability that the return is less than −5% if the return is normally distributed is _______.

Definitions:

Fluency

The ease and smoothness of communication, often referring to language proficiency, but can also apply to the seamless interaction within teams and systems.

Flexibility

The ability to adapt to new, different, or changing requirements and situations with ease.

Originality

The quality of being novel and not derived from something else; creativity in thought or expression.

Janusian Thinking

A cognitive approach characterized by considering opposing ideas or concepts simultaneously, facilitating creative and innovative solutions.

Q1: The following data,drawn from a normal population,are

Q25: A sociologist estimates the regression relating Poverty

Q28: A researcher analyzes the factors that may

Q36: A financial analyst maintains that the risk,measured

Q43: Calcium is an essential nutrient for strong

Q54: The following frequency distribution shows the monthly

Q63: Consider the following simple linear regression model:

Q69: Suppose Bank of America would like to

Q70: Which of the following is the value

Q119: Vermont-based Green Mountain Coffee Roasters dominates the