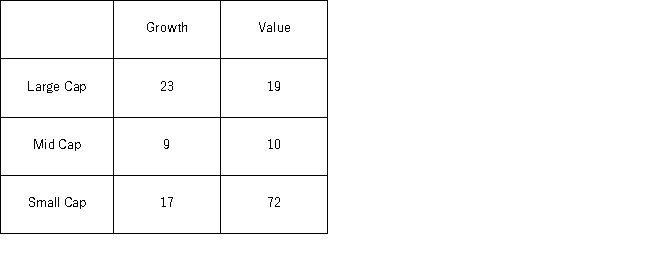

The following table shows the cross-classification of hedge funds by market capitalization (either small,mid,or large cap)and objective (either growth or value).  a.Set up the competing hypotheses to determine if market capitalization and objective are dependent.

a.Set up the competing hypotheses to determine if market capitalization and objective are dependent.

b.Calculate the value of the test statistic and determine the degrees of freedom.

c.Compute the p-value.Does the evidence suggest market capitalization and objective are dependent at the 5% significance level?

Definitions:

Securities Analysis

The process of evaluating a security (stocks, bonds, etc.) in terms of its risk, value, and investment potential.

Fundamental Analysis

An approach to determining the intrinsic value of a security by examining related economic, financial, and other qualitative and quantitative factors.

Turnaround

The financial recovery of a company that has been performing poorly for an extended time.

Coca-Cola

A multinational beverage corporation known for its flagship product, Coca-Cola, a carbonated soft drink.

Q28: For the Jarque-Bera test for normality,the null

Q29: A correlation coefficient r = −0.85 could

Q35: A manager at a local bank analyzed

Q53: The heights (in cm)for a random sample

Q82: In August 2010,Massachusetts enacted a 150-day right-to-cure

Q88: Compared to the sample correlation coefficient,the sample

Q92: If the underlying populations cannot be assumed

Q101: A card-dealing machine deals spades (1),hearts (2),clubs

Q105: Consider the following sample regression equation <img

Q114: Serial correlation is typically observed in _.<br>A)